by Jeffrey Henning | Jul 30, 2019 | B2B Surveys, Consumer Surveys, In the News

People are generally expecting more personalized experiences because of the user-centric experiences they have on sites like Netflix and Amazon. A study from Researchscape International suggests 96% of respondents believe a customized approach can help build...

by Jeffrey Henning | Jun 26, 2019 | B2B Surveys, Consumer Surveys, Employee Surveys, In the News, Retail Surveys

PDI, a Loyalty360 member specializing in enterprise software solutions for convenience retail, petroleum wholesale, and logistics industries, has received some recognition lately, and they’ve discussed some recent projects with Loyalty360. Never one to rest, PDI has...

by Jeffrey Henning | Jun 18, 2019 | Consumer Surveys, Food and Fitness Surveys, Healthcare Surveys, In the News, Nonprofit Surveys

Plant-based meat alternatives like Beyond Meat and Impossible Burger are popping up everywhere, from fast food chains to the stock market. 4A’s Research partnered with Researchscape, an agile market research consultancy, to survey 1,000 consumers on their eating...

by Jeffrey Henning | Apr 19, 2019 | Arts & Entertainment Surveys, Consumer Surveys, consumer-research, Games Industry Surveys, In the News, MRX Surveys

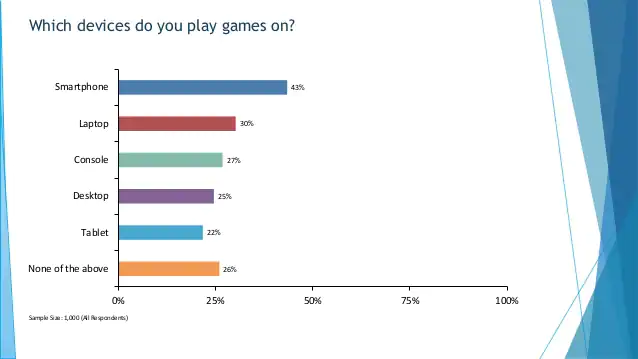

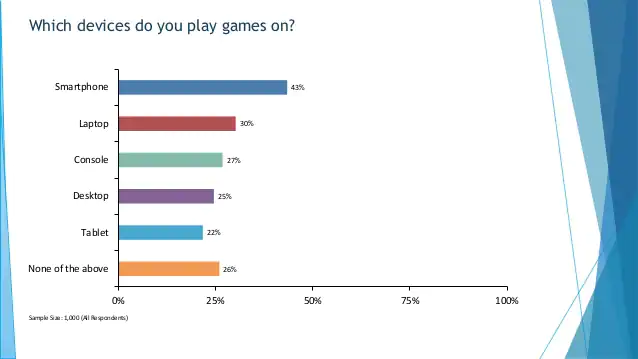

Three out of four U.S. adults who are online (76%) play games on devices: 43% play on smartphones, 30% on laptops, 27% on consoles, 25% on desktops, and 22% on tablets. A quarter play 1-2 hours a week, another quarter play 3-5 hours a week, and a fifth play 6-9 hours...

by Jeffrey Henning | Apr 18, 2019 | B2B Surveys, Consumer Surveys, Energy Sector Surveys, In the News, Major Media

Consumers are generally unaware of how they can take their energy use into their own hands and help to reduce greenhouse gas emissions (GHG), and ultimately, the impacts of climate change. Inspire commissioned Researchscape International to conduct a survey of 1,000...

by Jeffrey Henning | Apr 4, 2019 | B2B Surveys, Consumer Surveys, In the News, Nonprofit Surveys, Retail Surveys

A recent 4A ‘s survey, conducted with Researchscape, shows the main reasons consumers stop shopping a brand are quality, price, reliability and trust. Of note, 25% of respondents said they had political reasons for why they stopped doing business with a brand,...