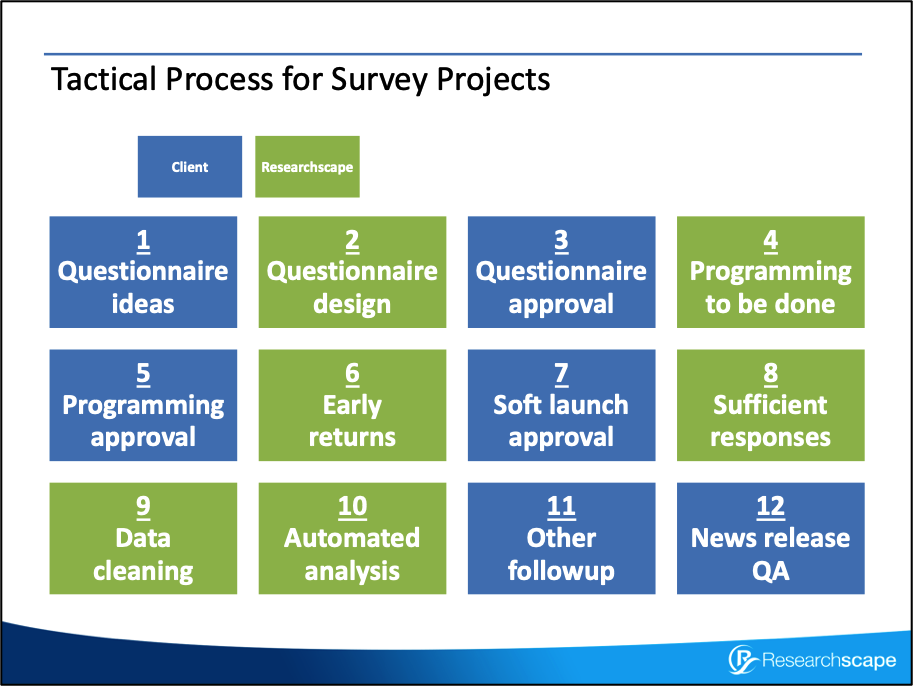

Successful surveys are a relay race, handing off between the client and research firm at multiple steps: transforming questionnaire ideas into a questionnaire design, responding and iterating on early returns, then honing in on the headlines and developing the analysis.

- Questionnaire ideas – While you may have some basic ideas for what you want to learn from your survey, we’ll walk you through a structured agenda to brainstorm the basis for the study. (See Collaborating to Design Effective Questionnaires.)

- Questionnaire design – We’ll prepare the first drafts of the questionnaire, following best practices that stand up to journalistic scrutiny. (See 10 Tips for Questionnaire Design.) We’ll collaborate with your team in Google Docs or Office 365.

- Questionnaire approval – This is where we wait for signoff, which is typically just a few days. However, it can take weeks or even a month to get CMO signoff. If you are doing medical research and need approval from an Institutional Review Board (IRB), approval might take months and involve a few rounds of changes.

- Programming to be done – We convert your questionnaire into a markup language to speed up programming. Typically we program questionnaires within a day or two.

- Programming approval – For surveys of your own house list, you’ll want to validate that we’ve matched your branding. For surveys of our own lists, we skip this step.

- Early returns – Initial results can arrive in minutes for a broad consumer study or over days for a narrow B2B or HCP study.

- Soft launch approval – For a consumer study with a typical target of 1,000 to 2,000 responses, we’ll pause after the first ~100 results and create a dashboard for your team to review. Such results are highly predictive of the final findings. For a B2B study, which is typically 250 to 500 responses, we’ll pause after the first ~50 results. Seeing actual results often prompts ideas for adding follow-up questions.

- Sufficient responses – The majority of a schedule for a market-segment survey or a multinational survey is collecting the data. While fielding is ongoing, we’ll also make sure our analytic engine is configured so that we can quickly turn around surveys, setting up weighting and crosstabs.

- Data cleansing – Our partnership with Device ForensIQ keeps bad actors from getting into surveys in the first place, but we review final results to remove trivial partial responses and those from inattentive respondents.

- Automated analysis – We use our proprietary platform ResearchStory to turn around final reports the same or next day after closing a survey.

- Other follow-up – We’ll present the key findings to you and orient you to the detailed deliverables to support your own analyses.

- News release quality assurance – If you’re announcing the results, we’re happy to double check all the stats in the press release. (See Common Mistakes when Writing Survey News Release.)

This proven process can be as quick as a few days or as long as a few months, with the pace varying either by narrowness of audience or difficulty getting approvals. We’ll handle all the heavy lifting, and we’ll guide you through each handoff in this relay race.