Back in June, Ray Poynter shared some great tips for how market researchers can use Google Insights for Search (see How to use Google Insights as a research tool [PDF]). In that same spirit, I want to encourage U.S. market researchers to check out Google Domestic Trends.

Where Google Insights for Search lets you track specific search terms, and compare and contrast them to other search terms, Google Domestic Trends instead tracks groups of related search terms designed to represent a sector. For instance, the Google Auto Buyers Index include keywords such as “cars”, “kelley blue book”, “auto”, “used cars”, “toyota”, “autotrader” and more. Each index tracks only U.S. search volume and is typically set to 1.0 for January 1, 2004, then tracked as a 7-day rolling average. Google Domestic Trends are part of the Google Finance tools, and any index can be compared to major stock markets, mutual funds or individual stocks.

Google currently offers 27 indices, from the Google Advertising & Marketing Index to the Google Unemployment Index. Google researchers evaluated the predictive validity of precursors to the Google Domestic Trends indices for retail sales, automotive sales, home sales and travel:

We have found that simple seasonal AR models and fixed-effects models that include relevant Google Trends variables tend to outperform models that exclude these predictors. In some cases, the gain is only a few percent, but in others can be quite substantial, as with the 18% improvement in the predictions for ‘Motor Vehicles and Parts’ and the 12% improvement for ‘New Housing Starts’.

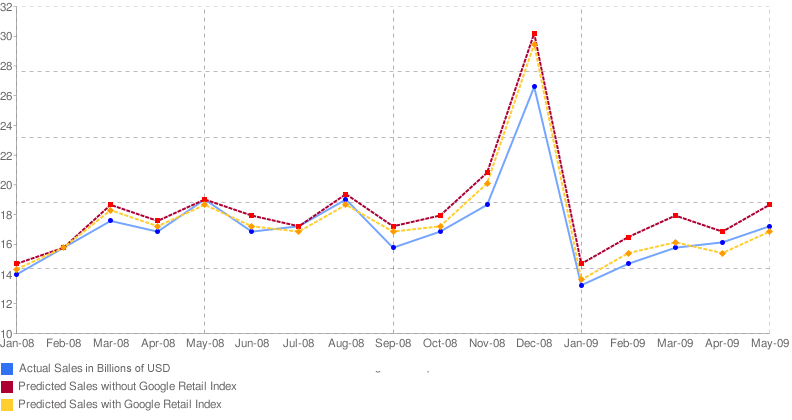

One example of a model including a Google Domestic Trends index outperforming a model without it uses the Google Retail Index:

Independent academic validation has yet to follow, as academic researchers are more likely to use Google Insights for Search as leading indicators. Little academic research has been published yet to demonstrate the predictive validity of Google Domestic Trends (“Extracting Latent Economic Signal from Online Activity Streams” by Joseph Reisinger of the University of Texas at Austin uses to Twitter and Yelp activity to predict a range of measures, including indices from Google Domestic Trends).

Given the expense of survey tracking studies, tools such as Google Domestic Trends offer the possibility of supplementing or interpolating results in order to save money by decreasing survey frequency.

References

Google, Google Domestic Trends, retrieved 15 July 2012.

Google, “Predicting the Present with Google Trends” [PDF], 10 April 2009, Hyunyoung Choi and Hal Varian.