The “retail apocalypse” has been accelerating, with 11,000 U.S. stores expected to close this year, surpassing last year’s record of 105 million square feet lost.

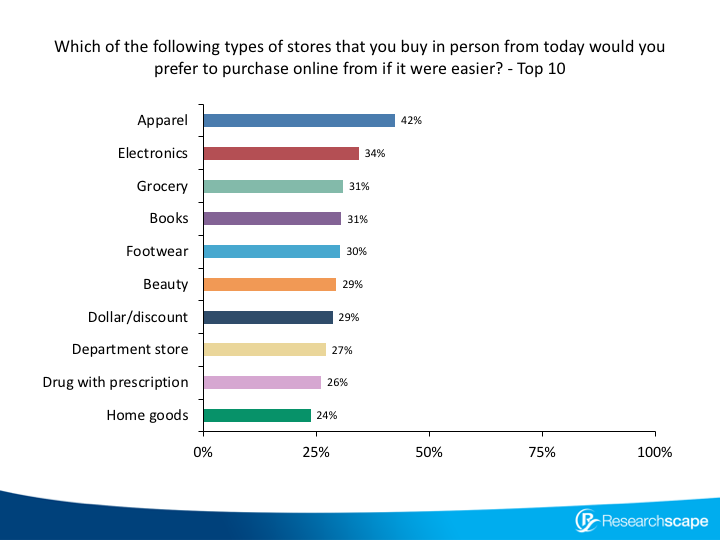

In an omnibus question fielded to 2,000 U.S. adults from May 26 to May 28, 2018, Researchscape asked which of 29 retail categories consumers would prefer to purchase online, if it were easier. The top four categories were apparel (42% of consumers would prefer to buy online, were it easier), electronics (34%), grocery (31%), and books (31%). (Books?!)

Three out of ten would buy more footwear and beauty products online if it were easier. And 29% would purchase dollar/discount items online.

Less susceptible to sales shifting online were superstores (12%), membership clubs (11%), and rent-to-own stores (8%).

Rank Option Response % 1 Apparel 42% 2 Electronics 34% 3 Grocery 31% 4 Books 31% 5 Footwear 30% 6 Beauty 29% 7 Dollar/discount 29% 8 Department store 27% 9 Drug with prescription 26% 10 Home goods 24% 11 Hobbies and craft 23% 12 Gifts and novelty 22% 13 Beer, wine and spirits 21% 14 Supermarket 21% 15 Pet 20% 16 Furniture 19% 17 Baby/toys 19% 18 Drug without prescription 19% 19 Automotive 18% 20 Office supply 18% 21 Jewelry 18% 22 Convenience 18% 23 Videogaming 16% 24 Hardware 16% 25 Sporting goods 15% 26 Mass merchandise 14% 27 Superstore 12% 28 Membership club 11% 29 Rent-to-own 8% 30 None of the above 13%

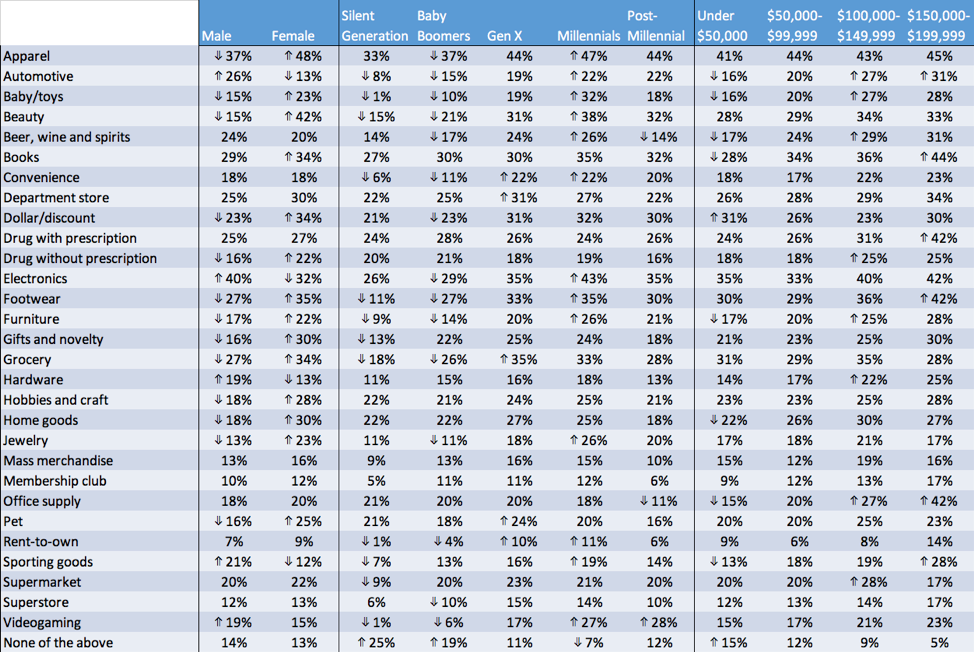

Women are more interested than men in shifting beauty, novelty, home goods, footwear, dollar, and apparel purchases online. For 13 of the 29 retail categories, Millennials have higher interest in shifting purchases online than U.S. adults on average do; conversely, Boomers have lower interest for 15 of the 29 categories. Higher-income households have higher purchase interest in more categories, with one exception: interest in purchasing online from dollar stores is highest among those making less than $50,000 a year, at 31% compared to 23% of households making from $100,000 to $149,999.

With such strong interest in shifting retail purchases online, 2019 might have even more store closings and lost square footage than 2018.