The most prominent measures of consumer confidence in the U.S. economy are:

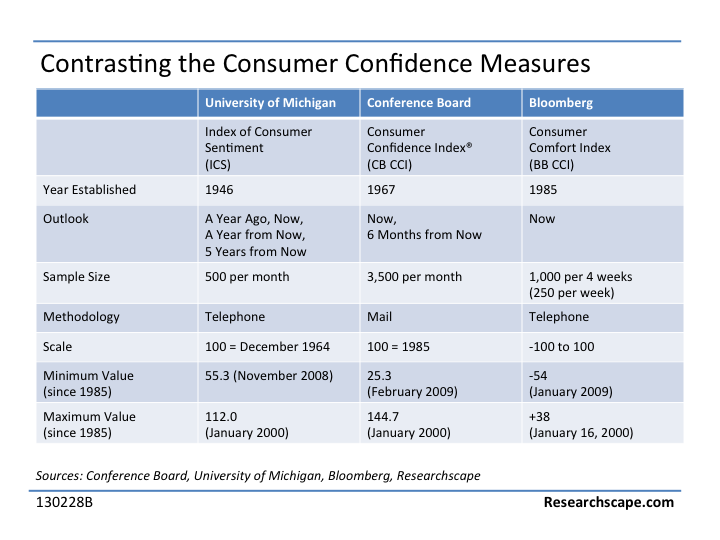

- The University of Michigan’s Index of Consumer Sentiment (ICS), established in 1946.

- The Conference Board’s Consumer Confidence Index® (CCI), established in 1967.

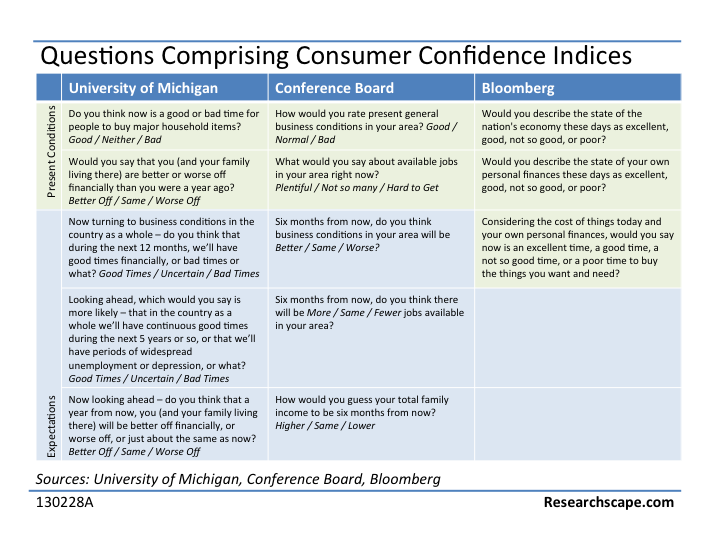

Both average the results of 3 to 5 questions. The ICS and CCI each pose 5 questions to consumers: 2 questions about the present condition of the economy and 3 questions about expectations. [Click the graphic for a larger version.]

Besides different questions, many other aspects of the indices differ. Most important is sample size and mode of interviewing: the ICS relies on 600 monthly telephone interviews, the CCI is a monthly online survey sent to 3,000 households.

Both the ICS and CCI have renormalized their results during their history: for the ICS, 100 = consumer confidence in the month of December 1964; for the CCI, 100 = consumer confidence for the year 1985.

The predictive power of U.S. consumer confidence measures have been analyzed for many different economic variables:

- GDP – The correlation between consumer sentiment and GDP growth: “Variance decompositions suggest that consumer sentiment accounts for between 13 and 26 percent of the innovation variance of [GDP].”

- Consumption – Growth in consumption above and beyond changes in labor income.

- Durable goods spending – The interrelationship between household spending on durable goods and consumer sentiment, with greater confidence leading to more willingness to incur debt.

- Eurozone consumer confidence – A leading indicator of consumer sentiment in the Eurozone, reflecting the large role the U.S. consumer plays in the world economy.

The challenge with such confidence measures is that consumer sentiment both shapes and reacts to economic changes.

While most of the above studies were based on the ICS, an investigation by the Federal Reserve Bank of New York found that the CCI offered greater forecasting power for most categories of spending.

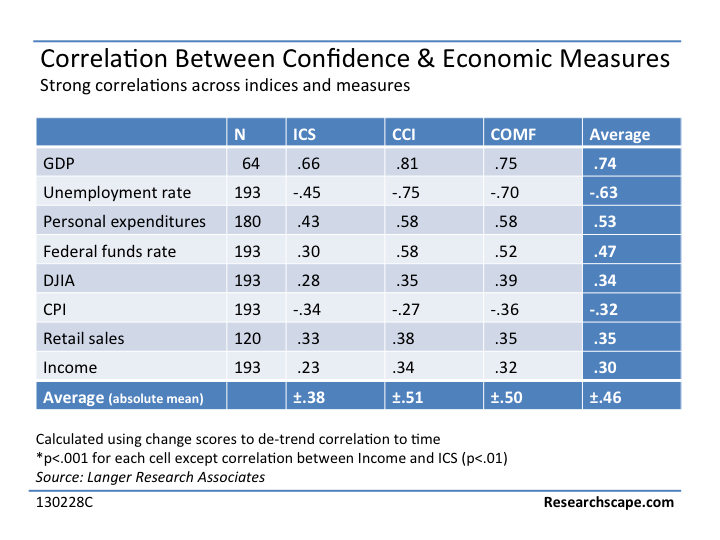

Langer Research Associates, creators of COMF, report the following correlations:

In our work, we are less concerned about the relative merits of each separate index, finding each of them to offer value. Accordingly, we calculate the CCAI, the Consumer Confidence Average Index, across all three measures.

Note: The Bloomberg index (COMF) was discontinued in 2022.