Researchscape conducted an online survey of 1,051 U.S. adults from November 14 to 17, 2025, to understand how closely they were following the Paramount acquisition by Skydance and how important, if at all, Star Trek was for them to subscribe to Paramount+.

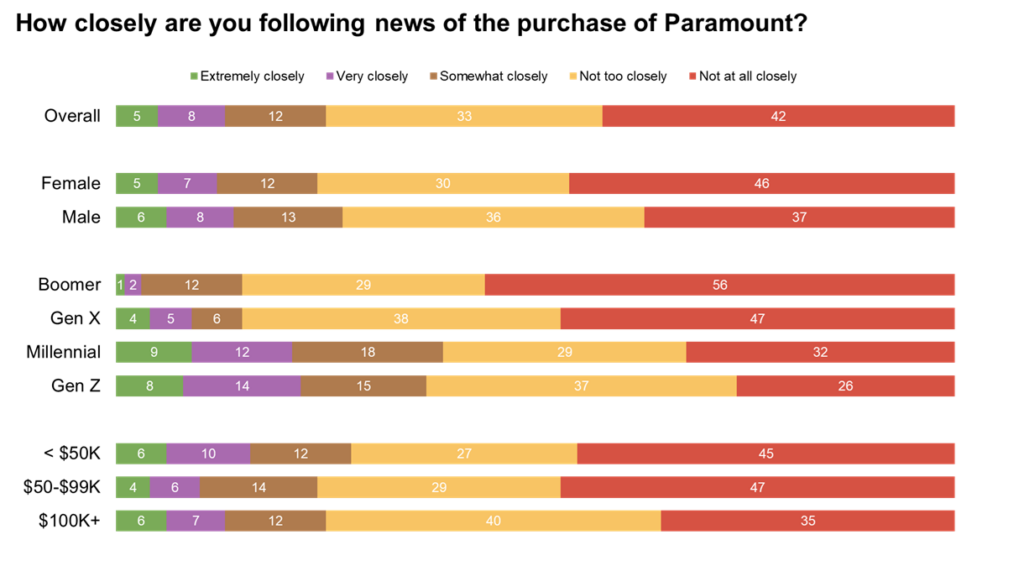

Only 13% of American adults are following the news of the purchase of Paramount very or extremely closely; 21% of Millennials and Gen Z are following the news that closely, compared to just 9% of Gen X and 3% of Baby Boomers.

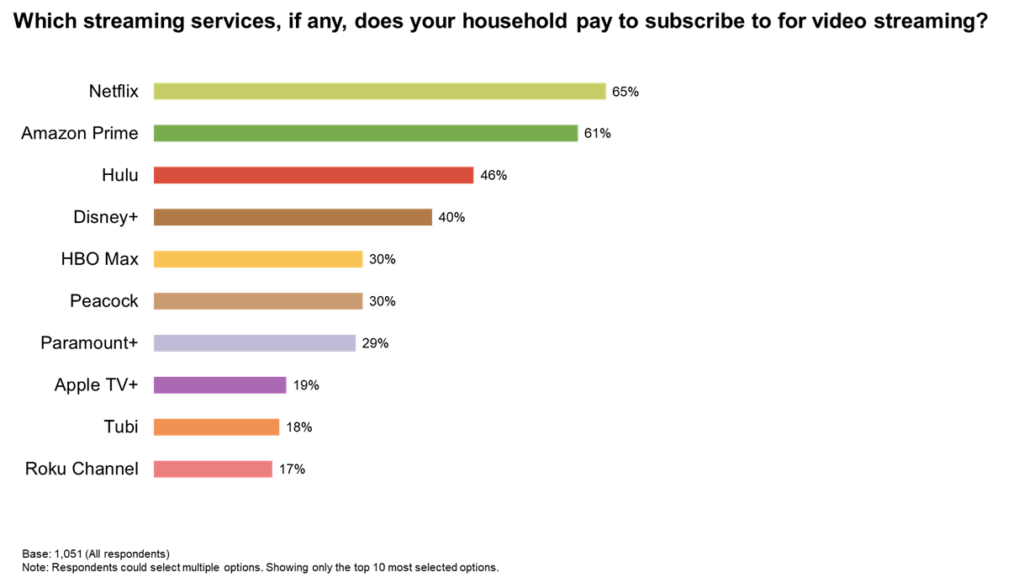

About three out of 10 Americans live in households that subscribe to Paramount+, about the same rate as HBO Max (which Paramount is interested in acquiring) and Peacock. Who subscribes to Paramount+ doesn’t vary at a statistically significant rate by gender, generation, or household income.

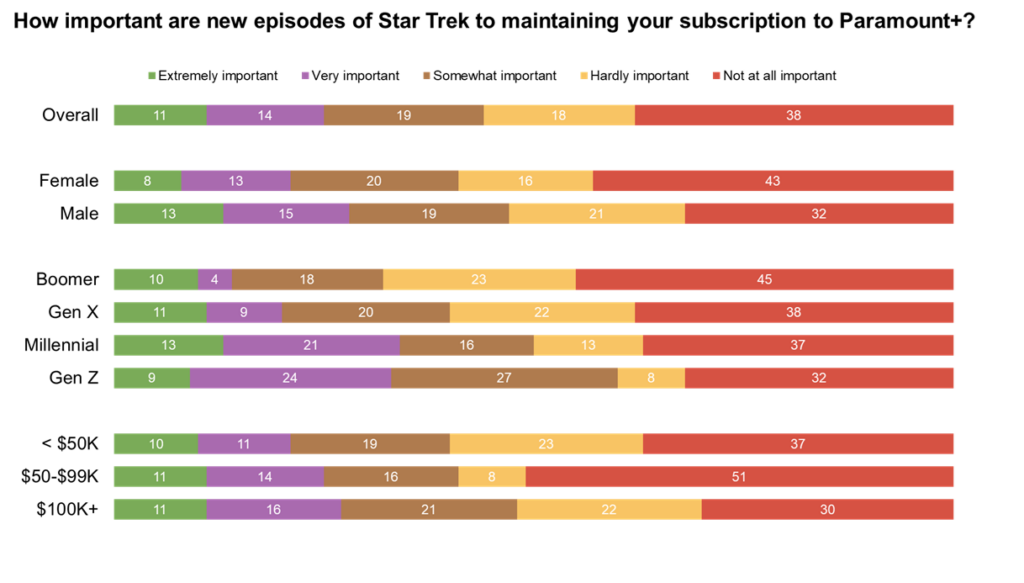

Only 25% of Paramount+ subscribers say Star Trek is extremely or very important to maintaining their subscription, but this number jumps for younger generations: 34% of Millennials and Gen Z vs. 20% of Gen X and 14% of Boomers. It also matters more to men (28%) than women (21%).

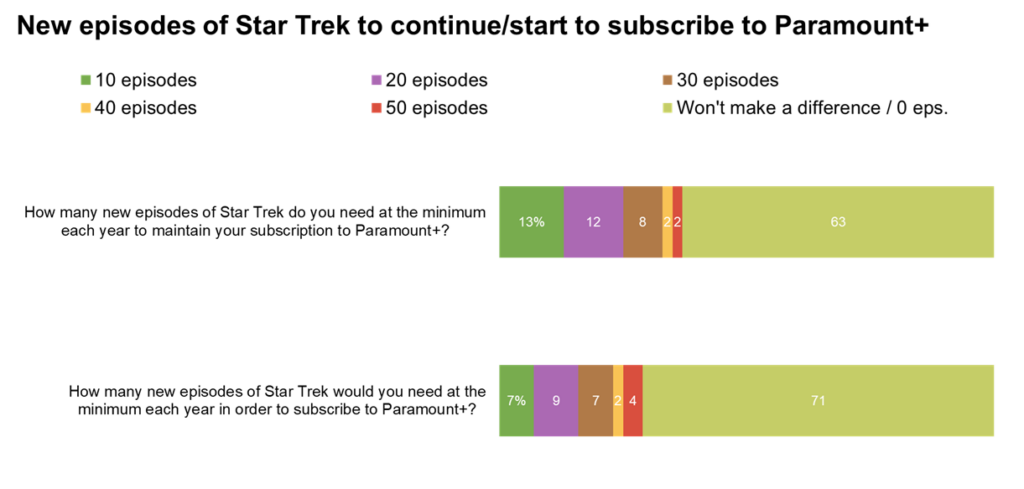

Now, this is a hypothetical question: how many Star Trek episodes a year are important to subscriptions? With only 10 episodes in the past year (Strange New Worlds, Season 3), the 24% who say they need 20 to 50 episodes to maintain their subscription haven’t canceled yet despite saying they want more episodes than were provided. And the 7% of non-subscribers who said 10 episodes a year are enough (2025’s count) and the 9% who said 20 episodes are enough (which will start to happen with the first season of Star Trek: Academy) have reason to sign up, if this was the only thing important to them.

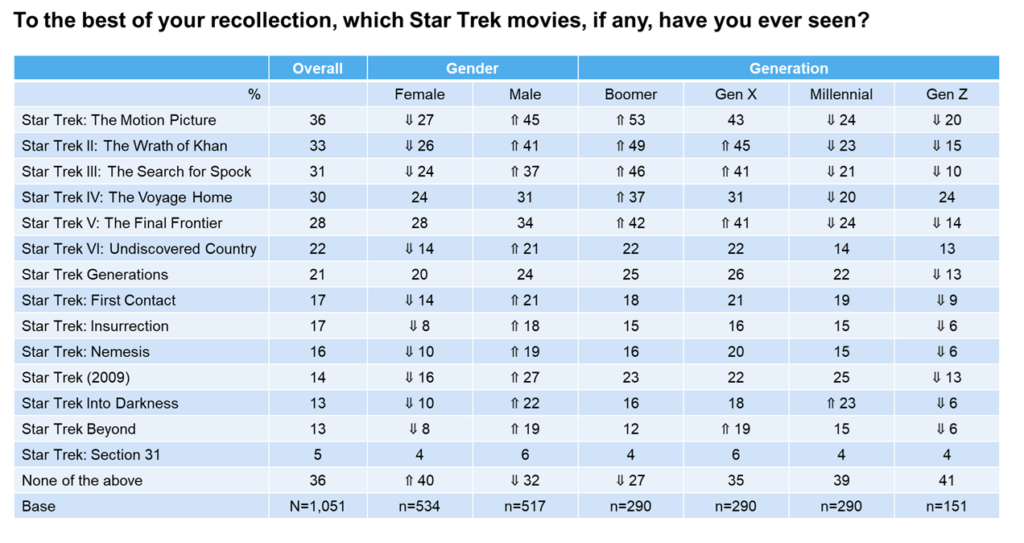

For each Star Trek movie, more men than women have seen it. Boomers are more likely to have seen the TOS movies (those with The Original Series cast) than any other generation. Gen X has seen Star Trek Beyond more than any other generation; Millennials have seen Star Trek Into Darkness more than any other generation. Gen Z, almost across the board, has seen the movies at lower rates than their elders.

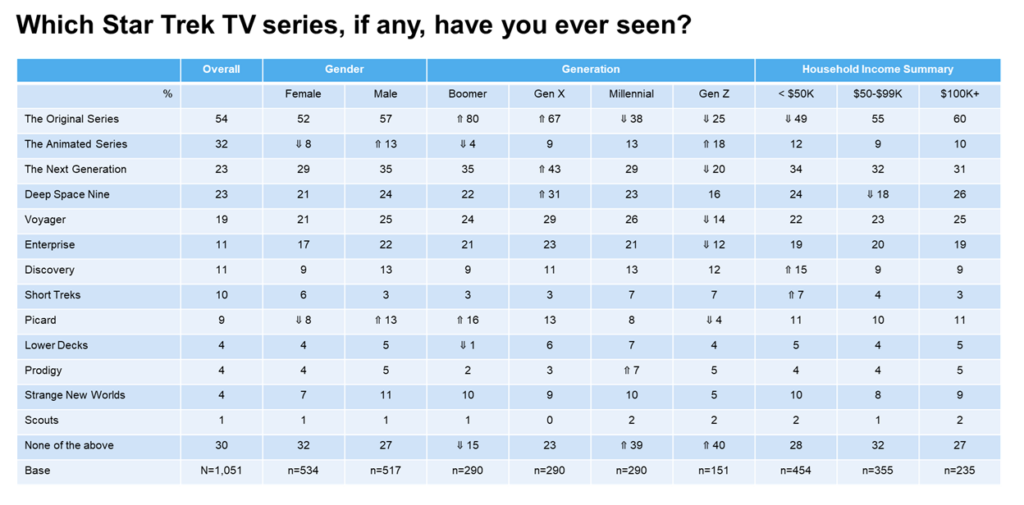

The vast majority of Boomers have seen The Original Series (80%), and two out of three Gen X have seen it (67%). Only 38% of Millennials and 25% of Gen Z have, but those are still higher rates than any of the other TV shows. Every generation has seen TOS more than any other show. Gen Z are more likely to have seen The Animated Series than any other generation, though one wonders if some respondents confused it with the animated series Lower Decks (which they have not seen at a higher rate).

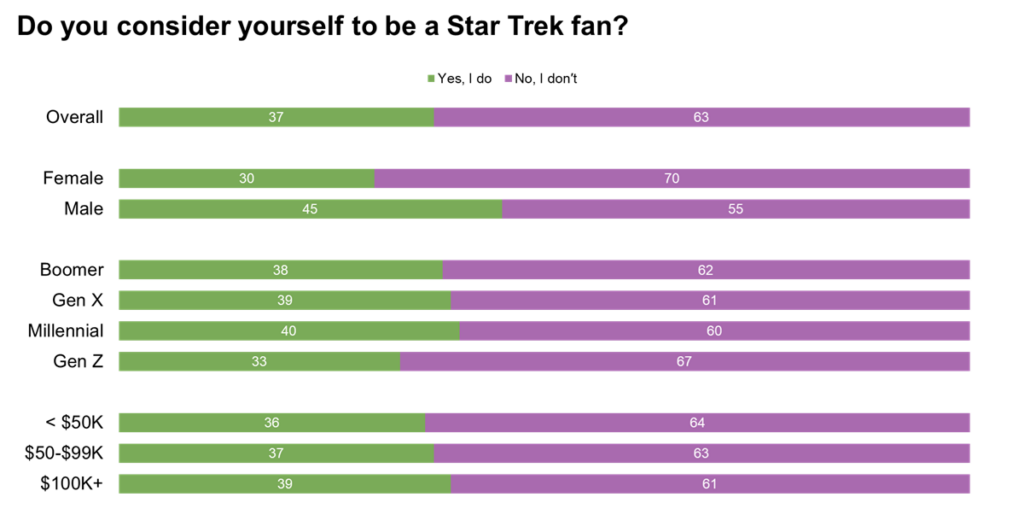

A shockingly high percentage of Americans consider themselves to be Star Trek fans: 37% overall. Men are half again as likely as women to be fans: 45% vs. 30% of women. There is a generational problem, which no doubt Star Trek: Academy is trying to solve: only 33% of Gen Z consider themselves fans, lower than the average of 39% for the older generations.

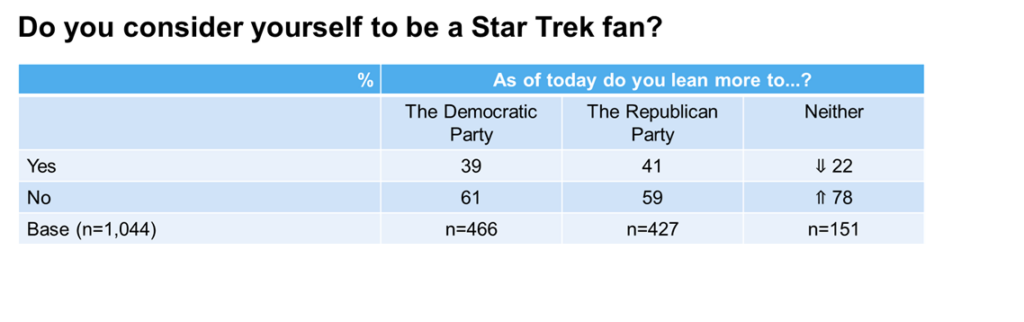

While many in the fandom argue that Star Trek is progressive and liberal, the fact is that those who lean toward either party are almost twice as likely to be fans than those who don’t align with either party.

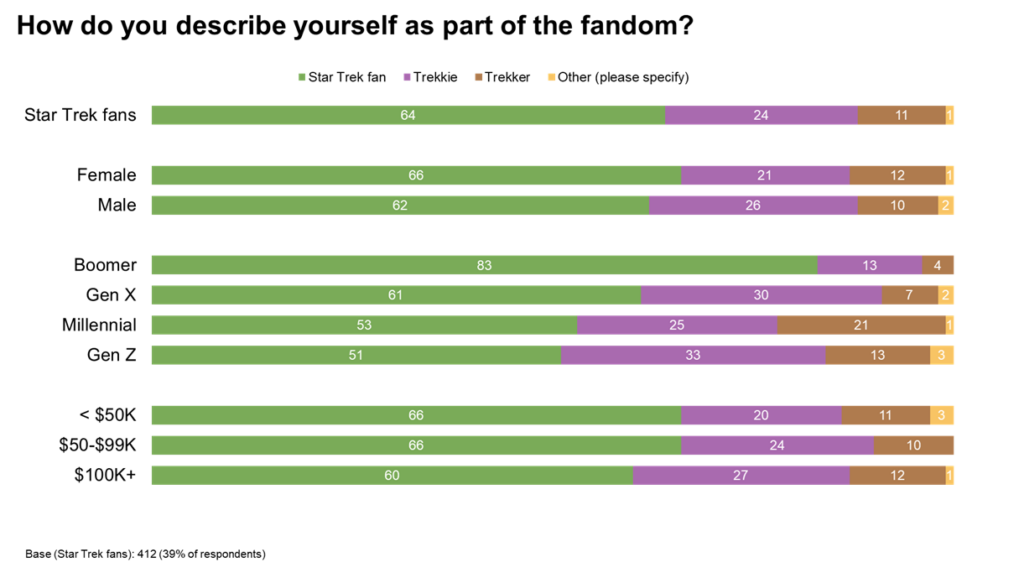

Of those who consider themselves fans, only 24% consider themselves Trekkies and 11% Trekkers. Boomers are least likely to consider themselves Trekkies.

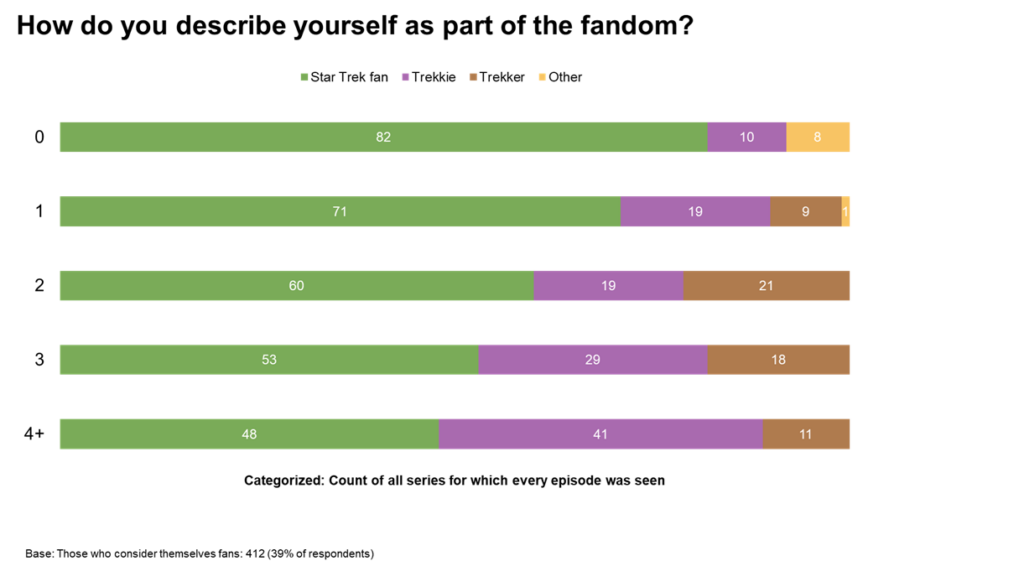

The more Star Trek TV series that someone has seen every episode of, the more likely they are to call themselves a Trekkie.

The data was weighted to the U.S. population by 9 demographic questions. The credibility interval for questions answered by all respondents is ±4 percentage points.