Market research is often reduced to two methods: surveys and focus groups. Of these, surveys are by far the most popular, thanks to the relative ease with which they can be conducted using free editions of online survey systems.

Yet the headlong rush to conduct surveys sometimes needs to be headed off.

Before assuming a survey is the best method, ensure you clearly understand the missing information that your research is expected to provide. Talk to the stakeholders who will use the data. Develop an understanding of their wants and needs. What are the specific decisions they need to make? What information do they currently have? Where are they uncertain about what the target audience believes?

From this, come up with a list of goals for the research. Then ask yourself whether a survey is really the best way to gather this information.

- Can you meet the goals without doing a survey at all?

- Are your potential respondents the only source of this information?

- If you work for a large organization, is a co-worker in another department doing a survey on this topic or researching this issue?

- Do your CRM, web analytics or other systems hold data that would help you reach your goal? You can ask website visitors their favorite sections of your web site, but using web analytics to study the traffic volume for the different sections will provide you better data.

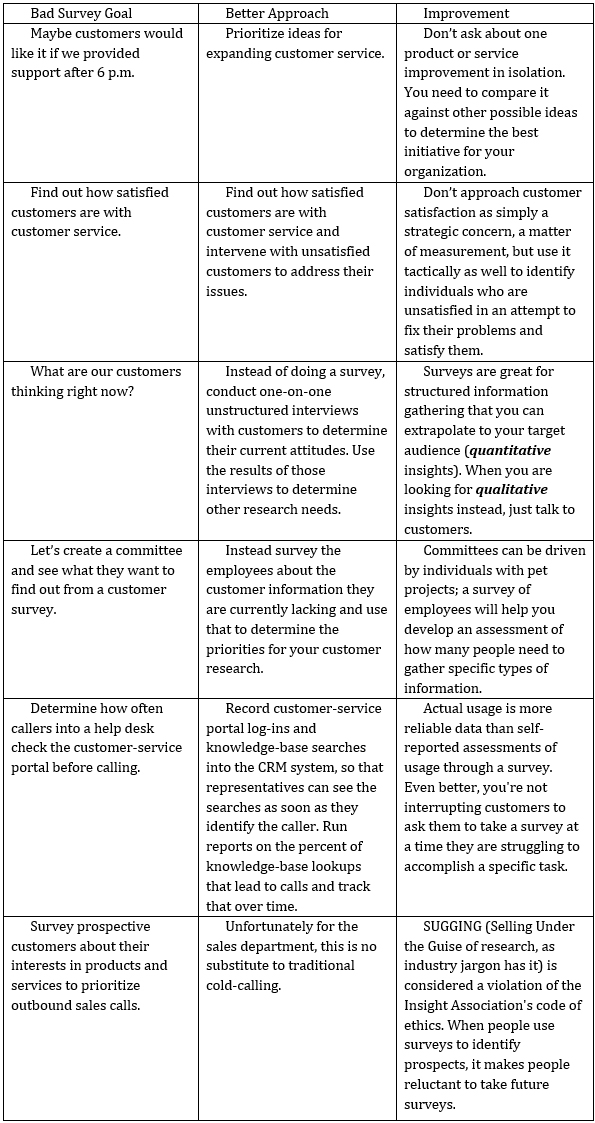

To help you, here are some examples of bad goals and better approaches.

Don’t let your survey project go astray from the start: be certain to focus on a specific goal. Be precise about what information you need to gather and what you plan on doing with it.

If your organization hasn’t done a survey in a while, the tendency is for every department to chime in with questions they want you to ask. The result: questionnaire design by committee, taking up more of your and your coworkers’ time to prepare, then producing a survey that is too long and tedious for respondents to complete quickly.

By setting a narrow goal you will be able to relentlessly simplify the survey and keep it on target.